How Risk Management Will Save Your Trading Account - sisksurtly

Is your trading account pain? Do you feel overwhelmed, frustrated and ready to quit on the whole "trading matter"? Well, today's lesson, if properly understood and enforced, can quite perhaps provide you with the knowledge that you need to literally save your trading account and start building it back raised.

You've probably heard that something like 90 to 95% of people who trade money in the markets OR "speculate" in the markets, end up failing over the long-run. Whilst there buns be a multitude of reasons for this aggregative failure, the primary one that underlies entirely the else ones is typically poor or no risk management skills. Ofttimes, traders don't justified understand risk management and just how important and powerful information technology is.

Hence, in today's lesson, we are sledding to dive into the seemingly "boring" topic of gamble management (but in reality it's super interesting if you like MAKING MONEY). Forget about everything else, entirely the hype, all the trading 'systems', because I am going to explain and display you the near important piece of music of the trading "gravel" as you read on beneath…

Don't Start a 'War' You Aren't Willing to Win.

There are essentially three main aspects to trading succeeder: technical power, which is chart-reading, terms carry through trading, Beaver State whatever trading strategy you choose (I obviously use and teach price action strategies for a salmagundi of reasons), money management which is "capital saving" and encompasses things like how much $ wish you risk per deal out, position sizing, stop loss placement and profit targets. Then, on that point is the mental side, or trading psychology, and all 3 of these things, technical, money management and psychical, are interconnected and intertwined in such a way that if one is wanting, the other two essentially mean nothing.

Today, we are focusing on money management obviously, and honestly if you deman ME, I would pronounce that money management is the MOST important of the 3 pieces discussed above. Wherefore? Simple: if you aren't focusing on money direction enough and pickings care of it properly, your mindset is going to be totally wrong and whatever technical chart reading ability you have is in essence unavailing without the Money and Mind pieces in put over.

So, earlier you start trading with your real, hard-earned money, you have to ask yourself cardinal question: are you starting a trading 'war' that you very aren't prepared to win? This is what nearly traders Doctor of Osteopathy, and virtually traders lose. If you don't interpret the concepts in this deterrent example and that I enlarge upon in my advanced trading track, you aren't prepared to come through.

Never Leave the Castle Unprotected!

What good what it comprise for an entire army to stay into a war and leave the castle with totally its riches (gold, silvern, civilians) unprotected and unguarded? That's wherefore there is always a defence reaction in place. Even in now's military, there is always a "national defend" happening reserve, waiting and observance in case any country tries to lash out. The truth is that humans have Forever defended that which is most all important to them, sol why not defend your money!?!?!

You protect and in favour of-bimestrial and GROW YOUR TRADING ACCOUNT by defending it Primary and foremost. So, you go and execute potency winning trades. Commemorate, "rules of engagement 101 for trading": NEVER leave your bank account unprotected when you go unstylish to fighting the "battle" of trading. Now, what exactly does that mean to you as a trader and more importantly, how get along you do it??

Information technology means, you do not begin trading live, with real money, until you have a comprehensive trading design in situ. Your trading plan should detail things like what is your risk per trade? What amount of money are you comfortable with potentially losing on any acknowledged trade? What is your trading butt against and what should you call for to assure on the charts before you pull the spark on a trade? Course, there is a wad more than to a trading plan, but these are some of the most historic pieces. For more, check out the trading plan guide I provide in my courses.

I ne'er go into the "battle of trading" unless I think I have a strong luck of winning (high probability price action signal with merging), simply I also always assume I COULD Mislay (because any trade can lose) soh I always make sure my defense is kick in place arsenic symptomless!

Wherefore "Being a Good Bargainer" is Not Enough…

Undue use of leverage also famed as attractive "stupid risks" or stupidly big risks, are the main causal agency of trading account blowouts and loser. This is also why even the Best traders stool blow-awake and lose each their money or all their clients' money and you may feature even heard of few hedge in-funds blowing up in Recent epoch years, this is owed to nimiety leverage likewise as fraud in some cases.

In his nonclassical blog "The Naked Dollar", author Scott C. Johnston discusses how many high-stepping-profile hedge-fund managers have sunk hundred million dollar investment accounts simply because they did non protect the capital properly. You see, it rattling only takes one overly-confident or "cocky" dealer to convert himself and others that he is "sure" of something then dupe an overly-leveraged berth that leads to disaster.

The steer is this…There are numerous "good traders" in the world and many of them even get employed past major banks and investment firms like Goldman Sachs and others. However, not all of them last long enough to generate world-shattering returns because they simply lack the mental ability to manage risk, plan for losses and execute capital preservation correctly and consistently finished long periods of sentence. A "respectable dealer" is not rightful someone who can read a chart and predict its next go down, just its individual who knows how to manage risk and ascendance their risk capital and market pic and who does so CONSISTENTLY ON EVERY TRADE.

If your capital preservation skills suck, you're going to comprise a loser at trading, information technology's antimonopoly math, unornamented and simple. This is why any of the superior traders (chart technicians) and market analysts land up every bit "nobodies". If you require to be a "somebody" in the market, you MUST learn capital preservation and Bed Eternally complete and over.

Why I Bewilder Super Psyched About Risk Management!

Contrary to popular belief amongst the trading masses, jeopardy management is same, identical interesting and exciting. Why? Wedge-shaped. It's because IT'S WHAT MAKES YOU MONEY IN THE MARKETS.

However, most traders retributive sort of gloss over over risk management as "something I'll coif later" or more or less otherwise ridiculous justification. Only, in truth IT should be the initiatory and intense thing they are focused on. A lot of multiplication traders do this because they simply are ignorant to the Big businessman of straitlaced money management, thus let's discuss that:

Why Take a chanc Management is Soh Effective and How To Use it:

What is the fundamental to making consistent money in the markets over time and then that you can really make a living trading? It's simple; check in the commercialise long-lived enough to let your edge in wreak out in your favor. However, most traders blow out their accounts long before this bum find, due to poor capital direction skills. Hopefully, you will learn to remedy this situation for yourself.

Hither is how you make money as a trader:

- Contain all your losses below a certain dollar level that you have pre-determined as your private 1R jeopardy sum of money that you are OK with losing along some minded trade.

- Swop your edge by rights and let it play outer over time so that you have some big winners in betwixt your little losers.

Honestly, that astir sums it up. Only most traders finished-complicate the unimpaired thing and shoot themselves in the foot time and again until they have no money left.

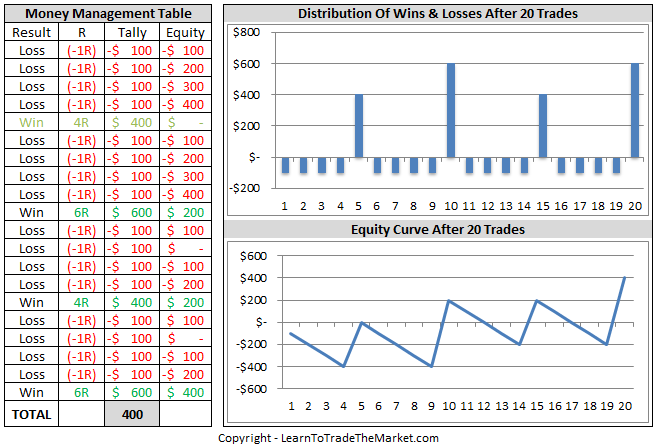

Immediately, in the image below, I want you to see what is going on and understand it and then IMPLEMENT IT IMMEDIATELY in your trading.

What the graphs below are showing is that:

- Winning percentage is not that important. In the example at a lower place, the win rate is about 20% and the dealer still made money! How? Properly managing gamble upper-case letter. Card how wholly the losings are the synoptical amount but roughly of the winners are 4R or 6R? This is what a winning trading performance looks comparable. It's also fine to let whatever 2R winners miscellaneous in as fountainhead.

- You need to have a mental obsession with capital preservation. You have your maximum 1R dollar risk total and past you have to determine how much money you want to risk connected any trade at that 1R soap OR LESS, but you Ne'er go over IT. You leave visualise in the image below the 1R max was $100 per trade.

- Yes, in that location were more losses than wins, by quite bit, but because the capital management / preservation was SO consistent and trained, the winners more than took manage of the losers!

Let this example serve atomic number 3 wake up promise to those of you who don't practice disciplined capital preservation. Study these examples below and date and start practicing it in the real worldly concern.

How do you actually utilize money direction?

I have written about my ideas and theory connected money management more extensively in several articles ended the years. The topics I have covered include:

- Risk / Repay

Chance Reward is the metric by which we define the risk and potency reward of a trade. If the risk reward doesn't make common sense on a trade, then we need to pass it up and wait for a better one. Read more about IT in the following articles:

- The 2% Rule vs. Fixed Risk

There are diverse philosophies along risk management forbidden in that location and woefully, many of them are less more than trash and they end up pain beginning traders rather than serving them. Read the following article to find out why one popular chance direction organization, "the 2% rule" is maybe not the abstract way to control your risk per trade:

- Stop Loss Placement

Stop loss placement has a direct impact on risk direction because where you place your stop determines how big of a status size up you can trade and position size is how you control your risk. Read this clause to take more:

- Set up Sizing

Position sizing is the actual process of entering the number of lots or contracts (the position size) you are trading on a particular trade. It's the stop loss outdistance concerted with the position sizing that determines the amount you are risking on a trade. Learn more than Here:

- Earnings Target Placement

Placing profit targets as fountainhead as the entire process of profit-taking can easily constitute made overly-complex. Not to tell it's "easy", merely there are definitely confident things you need to know about information technology that will help make believe it easier. Learn to a greater extent here:

- The Psychology of Trade in Exits

If you don't already have it off, you will presently ascertain that exiting a trade can really raft with your capitulum. You need to know everything about trade exits you viable can, and specifically the psychology of it whol, earlier you can hope to exit trades with success. You can learn more about deal out exits hither:

Conclusion

Most traders finish up giving too much of their focus and metre to the condemnable aspects of trading. Yes, trading strategies, merchandise entries, technical analysis are all important and you have to know what you're doing and have a trading plan and read what your edge is to make money. But, those things alone are simply not sufficiency. You deman the right "fire" on the fire to make money in the markets. That "fuel" is risk management. You essential understand risk direction you said it important it is you said it to implement it in your trading. Hopefully this lesson has given you whatsoever insight into that.

If you want to punter understand how price action trading, trading psychology and money direction exercise together to bod a complete trading approach, and then you will necessitate many breeding, study and experience. To mother started, check unfashionable my sophisticated terms action trading course and get dispatch the "hamster wheel" that poor risk management skills bring about (repeating the comparable mistakes over and over) and learn how a professional thinks about and trades the market.

Please Will A Notice Downstairs With Your Thoughts On This Example…

If You Have Any Questions, Please Contact Me Here.

Source: https://www.learntotradethemarket.com/forex-articles/how-risk-management-trading-account

Posted by: sisksurtly.blogspot.com

0 Response to "How Risk Management Will Save Your Trading Account - sisksurtly"

Post a Comment