trading strategies for overvalued stocks

What Does Overvalued Mean?

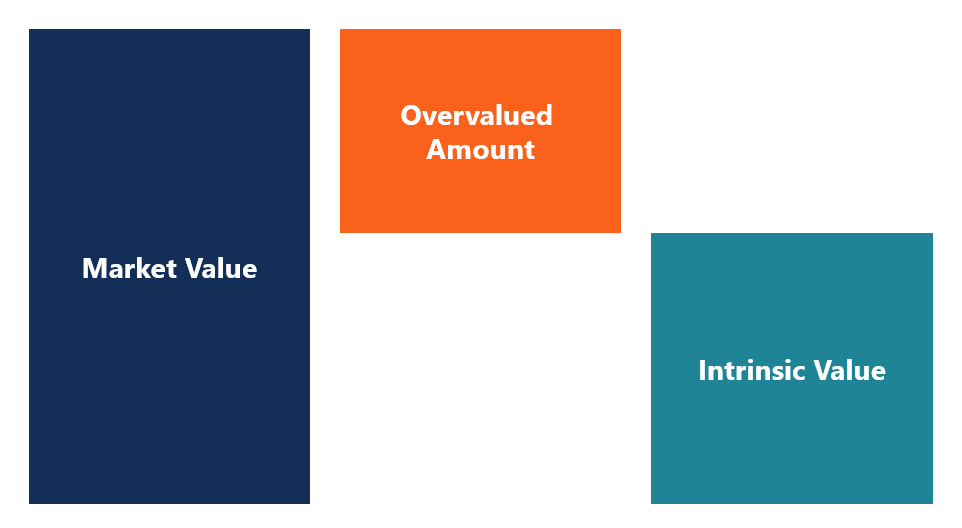

An overvalued asset is an investment that trades for more than its intrinsic value. For instance, if a company with an intrinsic value of $7 per share trades at a market value $13 per share, information technology is considered overvalued.

Intrinsic Value

An investment is else undervalued or overvalued compared to its intrinsic value. Because an investment's intrinsic value is personal, so is its "over/under" valued mark up.

As a refresher, the intrinsic value of an investiture is the price a rational investor would devote for the investment funds. The concept is most commonly depicted by the Final Present Value (NPV) of all future cash flows the investing will produce. For a recap on the subject, please see CFI's valuation methods guide , as good as the financial modeling guide , and types of financial models .

Undervalued vs. Overvalued

If the value of an investment (i.e., a stock) trades exactly at its built-in value, then it's well thought out fairly valued (within a reasonable margin). However, when an asset trades away from that value, it is then reasoned undervalued or overvalued.

Value vs. Ontogenesis Investing

Investors who take the conception of value investing will not buy up stocks that are above their essential value. Instead, they only look for opportunities to find "cheap" stocks. The diametrical of a value investor is a growth investor, which is person who believes that the broth is, in fact, not too big-ticket and will deliver more growth then the market (i.e., unusual investors) expect.

Improvident vs. Long Strategies

When a stock is overvalued, it presents an opportunity to go "short" by selling its shares. When a stock is undervalued, it presents an opportunity to go "long" by buying its shares. Sideste funds and accredited investors sometimes utilize a combination of short and long positions to play subordinate/overvalued stocks. To learn more about trading, check out CFI's technical analysis guide .

Ratios for Overvalued Investments

There are many tools investors can utilization to discover assets (usually stocks) that are deserving less than the price they have to pay for them. Here are some examples of ordinarily used ratios for assessing whether a stock is undervalued surgery not:

Price vs. Net Present Value (P/NPV)

Damage-to-NPV is the most complete method for valuing an investment. To perform P/NPV analysis, a financial analyst will create a financial model in Stand out to bode the business' revenues, expenses, capital investments, and consequent cash flow into the coming to determine the Net Present Value (NPV) .

Next, the securities analyst will compare the resulting treasure from the Discounted Johnny Cash Flow (DCF) analysis to the market price of the asset. Bank check down CFI's unrestricted financial modeling guide to learn many.

More Evaluation Ratios

If a securities analyst doesn't have enough time or information to make up a financial model from scratch, they may use other ratios to value the company, such as:

- Endeavour Treasure to Revenue

- Enterprise Value to EBITDA

- Price to Earnings

- Price to Book Value

- Damage to Cash Flow

- Dividend Issue and/Beaver State Dividend Payout Ratio

When using the commercial enterprise ratios above, it's important to avoid falling into the "overvalued trap." Since companies can regularly have fluctuations in their financial statements, the ratios may look more than unfavorable then they should be over the long term.

A accompany can often incur same-inactive expenses on their Net income and Loss (Pdanamp;L) Statement or include an asset write-off along their Balance Sheet when such accounting practices don't automatically represent the long-term anticipated performance of the company.

Additional Resources

CFI offers the Financial Modeling danampere; Valuation Analyst (FMVA)™ documentation program for those looking to take their careers to the next level. To keep eruditeness and advancing your career, the following resources testament personify helpful:

- DCF Simulate Guide

- Long and Snub Positions

- Stock Investing: A Guide to Ontogeny Investment

- Old-hat Investing: A Guide to Value Investing

trading strategies for overvalued stocks

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/overvalued/

Posted by: sisksurtly.blogspot.com

0 Response to "trading strategies for overvalued stocks"

Post a Comment