Best Forex Trading App Australia

Paper trading platforms are offered by online brokers and they allow y'all to buy and sell financial instruments in a chance-free style. This allows y'all to practice your trading endeavors without risking whatsoever funds and get used to how the broker in question works. The best paper trading platforms are also valuable when it comes to testing out new investment strategies and systems.

In this guide, we review the best paper trading platforms to consider in 2022.

Best Paper Trading Platform 2022 List

We found that the following online brokers offer the best paper trading platforms. You can read what each demo trading account offers by scrolling downward.

- eToro – Overall Best Newspaper Trading Platform 2022

- Capital.com – Best Paper Trading Platform for Beginners

- Libertex – Best Newspaper Trading Site with MT4 (Tight Spreads)

- TD Ameritrade – Best Paper Trading Platform for Testing Advanced Strategies

- Webull – All-time Paper Trading App for U.s. Investors

- Interactive Brokers – Best Newspaper Trading Simulator for Long-Term Investors

- Plus500 – Best Newspaper Trading Business relationship for Leveraged CFDs

- TradeStation – All-time Trading Simulator for Futures and Options

Visit site

67% of retail investor accounts lose money when trading CFDs with this provider.

Visit site

78.77% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

Visit site

83% of retail investor accounts lose money when trading CFDs with this provider.

Rating

| 5.0 | 4.nine | iv.half dozen | 4.6 | four.5 | four.4 | iv.4 |

Mobile App Rating

| 10/x | 9/x | 9/x | 8/x | 9/10 | 9/ten | 8/10 |

Min. Trade

| $25 | Due north/A | $i | £ane | North/A | N/A | $0 |

Leverage

| 1:xxx | 1:200 | 1:2 | 1:30 | From two:one | 1:12 in Margin Accounts | Upwards to 4:1 |

Margin trading

No. of Shares

| 2,000+ | 2425 | 5,000+ | 200+ | 1,500+ | 50+ | All US-listed Stocks |

No. of ETFs

| 150 | 250+ | 500 | 10 | 2,300+ | 39+ | 250+ |

Fixed fees per trade

| $0 | $0 | $0 | $0 | $0 | $0 | $0 |

Toll per Month

| $0 | $0 | $0 | $0 | $0 | $0 | $0 |

ETFs

| 0% | 0,01-2% | 0.00 | 0.i% - 0.175% | $0 | $0 | $0 |

Funds

| N/A | 0,01-2% | N/A | N/A | $0 | $49.95 or $75 | $19.99 for Mutual Funds |

CFDs

| one pip to 4.5% | 0,01-2% | N/A | Due north/A | North/A | N/A | N/A |

Savings Plans

| N/A | N/A | Due north/A | N/A | Yes | $0 | Northward/A |

Crypto

| 0.75% to four.5% | Due north/A | 0.00 | 0.1% - 1% | N/A | Northward/A | N/A |

Bonds

| N/A | N/A | N/A | Northward/A | $1 | $19.95 | $0 |

Trading Fees

| Spread | Spreads | None | Commission, overnight fee | $0 | $0 | $0 |

Withdrawal Fees

| $5 | $0 | 0.00 | £0 - £1% | $0 - $25 for Wire Transfer | $0 | $0 |

Inactivity Fees

| N/A | N/A | 0.00 | N/A | $0 | $0 | $0 |

Eolith Fees

| Northward/A | $0 | 0.00 | £0 | $0 | $0 | $0 |

Overnight CFD Position

| $0 | N/A | $0 | N/A | $0 | $0 | $0 |

Credit Bill of fare

Giropay

Neteller

Paypal

Skrill

Sofort

Sepa Transfer

Best Paper Trading Platforms Reviewed

When searching for the best paper trading platform for your needs – there are many things that y'all need to consider. For example, does the paper trading platform mirror live market conditions and how much will yous be given in demo funds?

If at some point you are also planning to trade with real money – y'all too demand to have a closer wait at what the broker itself offers.

Taking all of this into account, beneath we discuss the best paper trading platforms currently in the market.

1 . eToro – Overall Best Paper Trading Platform 2022

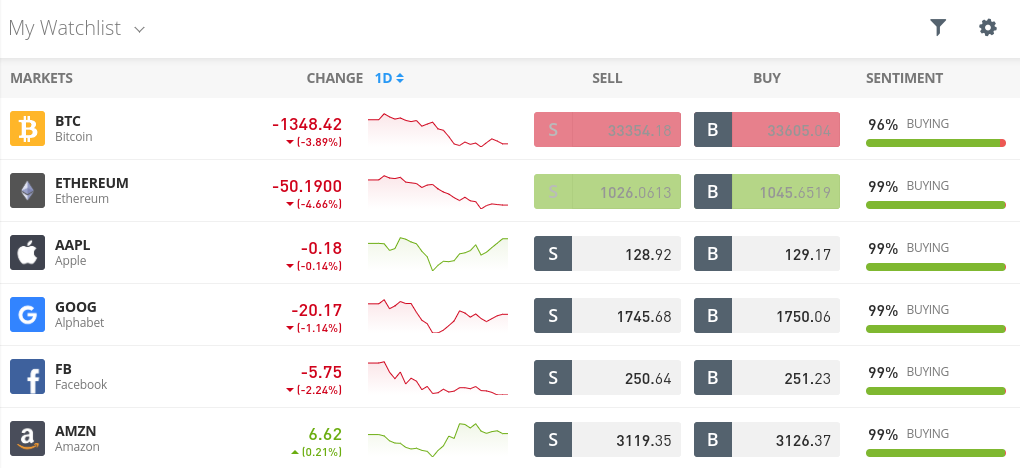

Non only does eToro offering the best paper trading platform of 2022 – merely it besides the best accommodating broker in the online space. Commencement and foremost, once you lot take registered an account at eToro – which takes less than a few minutes, yous can then start using the demo trading platform straight abroad.

Non only does eToro offering the best paper trading platform of 2022 – merely it besides the best accommodating broker in the online space. Commencement and foremost, once you lot take registered an account at eToro – which takes less than a few minutes, yous can then start using the demo trading platform straight abroad.

This means that there is no requirement to make a deposit in order to proceeds access. The paper trading platform at eToro comes pre-loaded with a demo balance of $100k. Almost chiefly, the eToro demo facility mirrors alive market weather. This ensures that yous can get to grips with how the online trading scene works in the most effective way.

Plus, you tin can switch betwixt demo and existent mode at whatsoever fourth dimension, and then there is no time limit on the paper trading facility. In terms of what you can trade, eToro supports more than than 2,400 stocks and 250 ETFs, and then it'due south a great choice for a stock demo account. This consists of more than 17 international marketplaces – including the United states of america, Uk, Hong Kong, and much of Europe.

You can also trade cryptocurrencies, hard metals, energies, forex, and indices. Each and every fiscal instrument available at eToro can exist traded commission-free. In that location are no ongoing platform fees and non-USD deposits toll merely 0.5%. Once you are gear up to start trading with real capital, eToro supports debit/credit cards, bank transfers, and eastward-wallets like Paypal.

You lot tin can trade directly from within your spider web browser – so there is no requirement to download any software. eToro is also available on a defended iOS and Android mobile app. The platform is heavily regulated – which includes licenses with the FCA (UK), CySEC (Cyprus), and ASIC (Australia). eToro is also registered with FINRA (USD).

eToro fees

Pros:

- Super convenient trading platform with 20 meg+ clients

- Buy stocks without paying any commission or share dealing charges

- 2,400+ stocks and 250+ ETFs listed on 17 international markets

- Merchandise cryptocurrencies, bolt, and forex

- Deposit funds with a debit/credit card, eastward-wallet, or bank account

- Ability to copy the trades of other stock trading pros

- Regulated by the FCA, CySEC, ASIC and registered with FINRA

Cons:

- Not suitable for advanced traders that like to perform technical assay

Your upper-case letter is at take a chance.

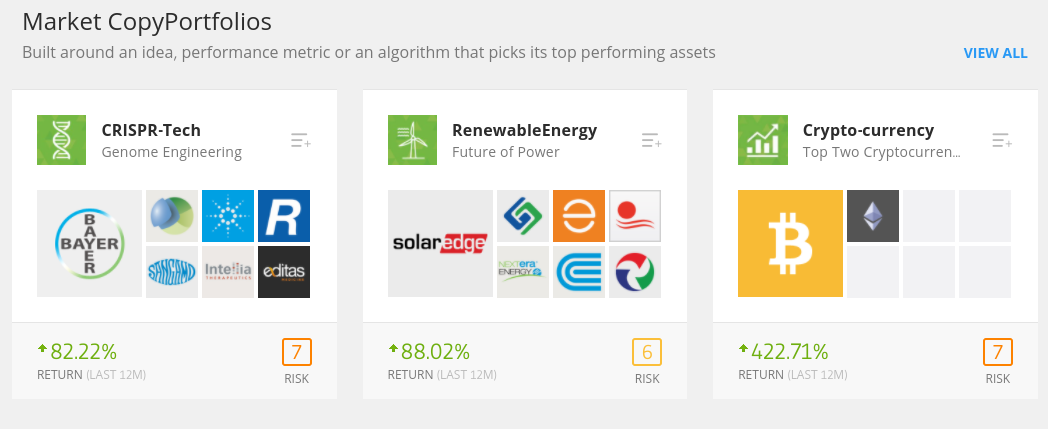

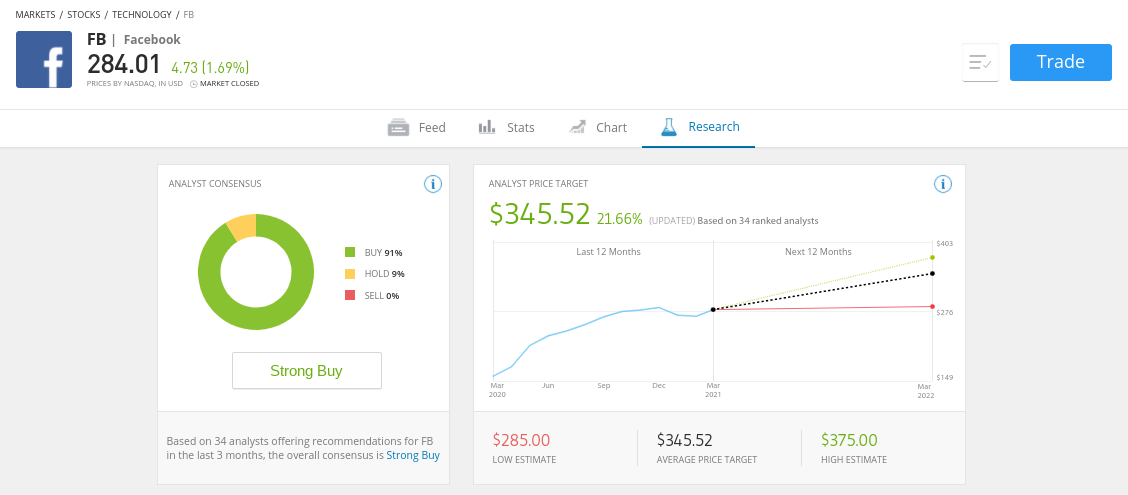

2. Capital.com - All-time Paper Money Trading Platform for Beginners

If you're a complete beginner and looking for the best paper money trading platform to learn the ropes of online investing - Capital letter.com is well worth because. This pop CFD banker offers a super-bones trading platform that is perfectly suited to newbies.

If you're a complete beginner and looking for the best paper money trading platform to learn the ropes of online investing - Capital letter.com is well worth because. This pop CFD banker offers a super-bones trading platform that is perfectly suited to newbies.

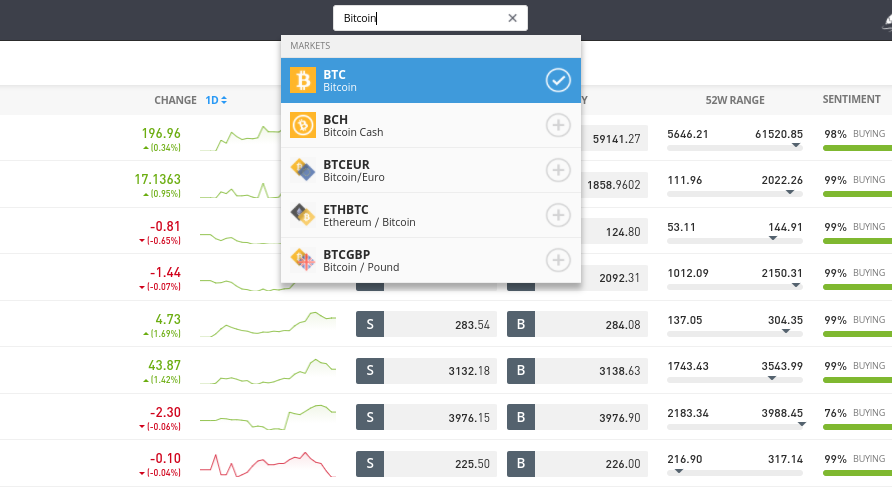

In one case you have registered an account, you can then commencement using the paper trading facility. This is available through the Capital.com web trading platform or via MT4, albeit, if y'all're a beginner it'southward best to opt for the former.

Either way, the demo facility at Majuscule.com mirrors live trading conditions. Yous volition have admission to thousands of stock CFDs from a magnitude of markets - likewise as ETFs, indices, cryptocurrencies, commodities, and forex. All assets at Capital.com tin be traded commission and with tight spreads - should yous wish to upgrade to a real money account.

What we as well like near Capital.com is that it offers a huge library of educational tools. This allows you to use the paper trading platform in conjunction with guides, video explainers, and mini-courses. And, when you eventually feel comfy to starting time trading with real capital - the minimum deposit is only £/$20.

This summit-rated CFD broker supports a broad range of payment types - including debit/credit cards, several due east-wallets, and bank transfers. Have notation, if opting for the latter, the minimum deposit jumps up to £/$250. Finally, your money is safe at Majuscule.com - as the platform is regulated past the FCA and CySEC.

Capital.com fees

Pros:

- 0% commission on all markets

- Low spreads

- Thousands of CFD instruments

- Spread betting for UK clients

- Perfect for newbies

- Minimum deposit of only $20

Cons:

- No traditional investments – CFD trading only

- Non suitable for experienced traders

75.26% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you tin beget to take the high risk of losing your coin.

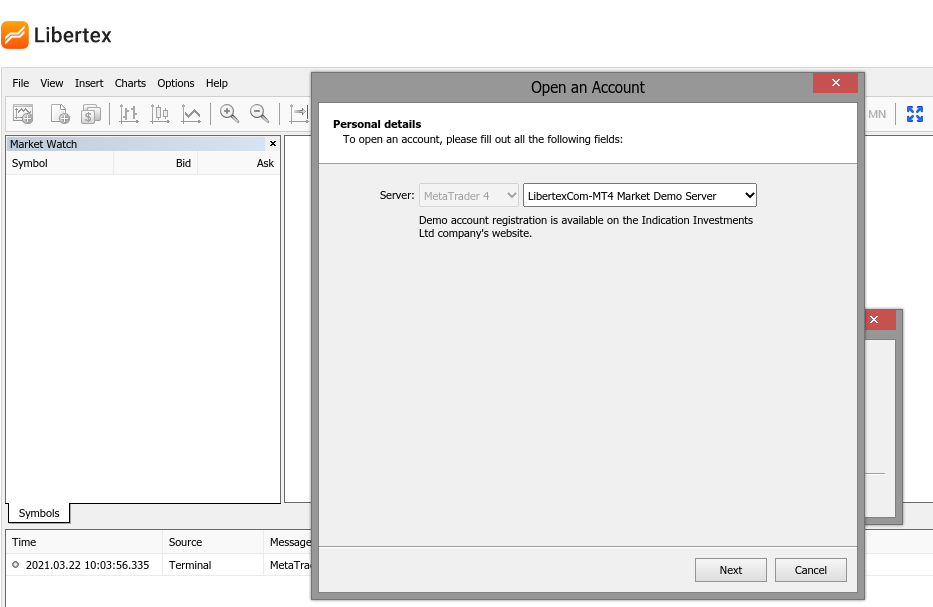

iii . Libertex – All-time Newspaper Trading Site with MT4 (Tight Spreads)

MetaTrader 4 (MT4) is one of the most popular tertiary-party trading platforms in the online arena - with support offered past over 1,000 brokers. For us, Libertex is arguably the best newspaper trading platform that is compatible with MT4 - not to the lowest degree considering it offers tight spreads on all markets.

In other words, the quote that you meet on-screen is applicable for both the bid and ask cost - so you don't need to pay any spreads whatever. This is ideal for day trading strategies that seek to target smaller margins. Plus, on many markets, Libertex doesn't charge whatsoever trading commissions.

Once you have opened an account with Libertex - you tin can then sign into MT4 with your login credentials. In doing so, you volition instantly have admission to €50,000 in paper trading funds. This volition allow yous to test out the ins and outs of what MT4 has to offer - in terms of its avant-garde society types, technical indicators, and chart drawing tools.

Furthermore, and perhaps about importantly, you tin can also deploy a fully automatic forex EA or forex robot. All yous demand to do is download the respective software file and install it into MT4. And so, you lot can activate the robot via MT4/Libertex and come across how it performs in live market conditions - in a completely risk-free manner.

If you then determine to use Libertex will real money - the minimum deposit is simply €/$100. You tin add funds with an east-wallet, debit carte, credit card, or bank wire. The platform supports a vast range of CFD trading instruments - covering stocks, commodities, digital currencies, indices, ETFs, and more than.

We should also notation that Libertex is a good choice if you lot are planning to trade with leverage. The broker offers up to 1:600 to professional clients, and less if yous are a retail investor. In terms of reputation, Liberext is regulated by CySEC and was first launched over two decades ago. Equally such, you will be using a highly trusted banker with a long-standing rail tape in this space.

Libertex fees

Pros:

- Tight spread CFD trading

- Very competitive commissions

- Expert educational resource

- Long established banker

- Merchandise stocks and indices like the Dow Jones

- Compatible with MT4

- Great choice of markets

Cons:

- Only offers CFDs

CFDs are complex instruments and come up with a loftier chance of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs piece of work and whether you can afford to have the high run a risk of losing your money.

4 . TD Ameritrade – Best Paper Trading Platform for Testing Advanced Strategies

Launched in 1975 - TD Ameritrade needs no introduction in the online brokerage scene. With more eleven million clients now using the platform - this top-rated platform gives you lot access to every asset class nether the sun. In particular, TD Ameritrade is behind one of the nearly intuitive trading platforms in the space - thinkorswim.

This trading platform - which can be accessed via desktop software, online, or via a mobile app - comes packed with advanced tools. This includes fully customizable screens, technical indicators, fundamental news feeds, and economic data.

Crucially, the thinkorswim newspaper trading platform is pre-loaded with $100k in demo funds. This means that yous can utilize the thinkorswim paper trading facility to exam out advanced strategies and systems without risking any of your capital.

Have note, nevertheless, if you lot wish to benefit from existent-time pricing quotes - you will first need to deposit $500 into your TD Ameritrade business relationship. If not, there will exist a slight filibuster in the market prices you run into on-screen. Even so, TD Ameritrade gives yous admission to thousands of financial markets - covering the likes of stocks, ETFs, mutual funds, futures, options, and forex. This is a huge nugget class compared to similar platforms such as Charles Schwab, yous can read our TD Ameritrade vs Charles Schwab review comparing for more than detail.

When buying and selling U.s.a.-listed stocks and ETFs in real mode - you won't pay whatever trading committee. Maybe the master drawback with TD Ameritrade - other than non being suitable for newbies, is that the account opening process tin be a scrap long-winded. Y'all can read more almost that in our Fidelity vs TD Ameritrade comparison review. As such, wait to wait a few days until your account is fully active.

TD Ameritrade fees

Pros:

- Trusted U.s. brokerage business firm

- App is bachelor on iOS and Android devices

- Buy stocks and ETFs commission-gratis

- Options tin be traded at just $0.65 per contract

- Fully-fledged paper trading business relationship

- More than than xi,000 mutuals to choose from

- No account minimums

Cons:

- Non every bit user-friendly as other investing apps in the market

- The sheer size of tradable markets on offer tin appear overwhelming

Your capital is at adventure.

5 . Webull – All-time Paper Trading App for US Investors

The mobile trading sector is growing at a significant rate - with most online brokers now offering an application for both iOS and Android. If you're based in the US and looking for the best newspaper trading app in the market place right now - consider Webull.

This super user-friendly brokerage app is platonic if you lot are looking for a simple fashion to purchase and sell stocks. This is because the app does not charge any stock trading commissions. This is also the case with cryptocurrencies, ETFs, and options.

In lodge to utilize the Webull newspaper trading platform, you volition first demand to open an account. This is standard-practice and requires some basic personal information from you. One time yous are set, you'll so demand to navigate to your account menu and select the 'Paper Trading' button.

Your account will then turn into 'Demo Mode' - which comes pre-loaded with a $1 million newspaper trading residuum. You tin can switch dorsum to 'Real Mode' at any given fourth dimension. Although Webull offers nada-committee trading, information technology is important to recall that a monthly fee does apply.

This starts at just $i per month on Standard Account - which needs to be paid even if you are only using the paper trading facility. Every bit such, yous should only utilise the demo account at Webull if at some point you are planning to apply the app to buy and sell assets with real money. There is no minimum eolith at Webull - which is neat if you eventually program to trade with pocket-size amounts.

Webull fees

Pros:

- Committee-free trading

- Global stock, ETF, options, and crypto trading

- Includes highly advanced technical charts

- Fully customizable indicators

- Fix up unlimited watchlists and complex alerts

- Includes basic social network and analyst recommendations

- Highly regulated in the US

Cons:

- Only available to US traders

- No forex or article CFD trading

- Payments are only by bank or wire transfer

- Limited educational resources

- Less than optimal customer back up

Your upper-case letter is at risk when trading at this site with real money

6. Interactive Brokers - Best Paper Trading Simulator for Long-Term Investors

Established brokerage firm Interactive Brokers offers one of the most all-encompassing asset libraries in the online investment scene. Put merely, you will accept access to over 135 markets from 33 unlike jurisdictions. This covers virtually every nugget class imaginable.

In detail, you can invest in a full suite of long-term investments - such equally stocks, ETFs, mutual funds, index funds, and fifty-fifty IPOs. Before we get to the fundamentals, we should notation that you lot volition be eligible for an Interactive Brokers paper trading simulator every bit soon as you register.

This comes pre-loaded with a newspaper balance of $1 million and all buy/sell positions mirror live market conditions. If y'all already have an account with Interactive Brokers, y'all tin switch over to demo fashion at whatsoever given fourth dimension. Either way, fifty-fifty if you blew through your $1 one thousand thousand demo fund balance, you can reset it whenever you wish.

Once you take tried the Interactive Brokers paper trading platform out and wish to beginning investing real majuscule - at that place is no minimum deposit required. You will, however, need to transfer funds from your depository financial institution account - as Interactive Brokers does not support debit/credit cards or e-wallets.

When it comes to fees - and similar most US-based brokerage sites these days, yous can buy and sell American stocks without paying whatever commission. Other markets will attract a dealing fee that volition vary depending on your account type of the respective asset or exchange.

Nosotros besides like the fact that Interactive Brokers offers a fractional trading facility. In simple terms, this means that yous can invest in whatever stock of your choosing from just $1 - irrespective of the share price. Partial ownership at Interactive Brokers is also available on Usa-listed penny stocks - equally long as the respective company has daily trading volume of $10 1000000 or more.

Interactive Brokers fees

Pros:

- Huge library of traditional stocks, index funds, and ETFs

- Really advanced trading features and chart analysis tools

- More than 135 markets beyond 33 countries

- Trade CFDs, futures, options, forex, and more

- No minimum deposit

- Purchase US-listed stocks and ETFs committee-costless

Cons:

- Not suitable for newbie investors

- Fee structure is a bit confusing

Your capital is at hazard.

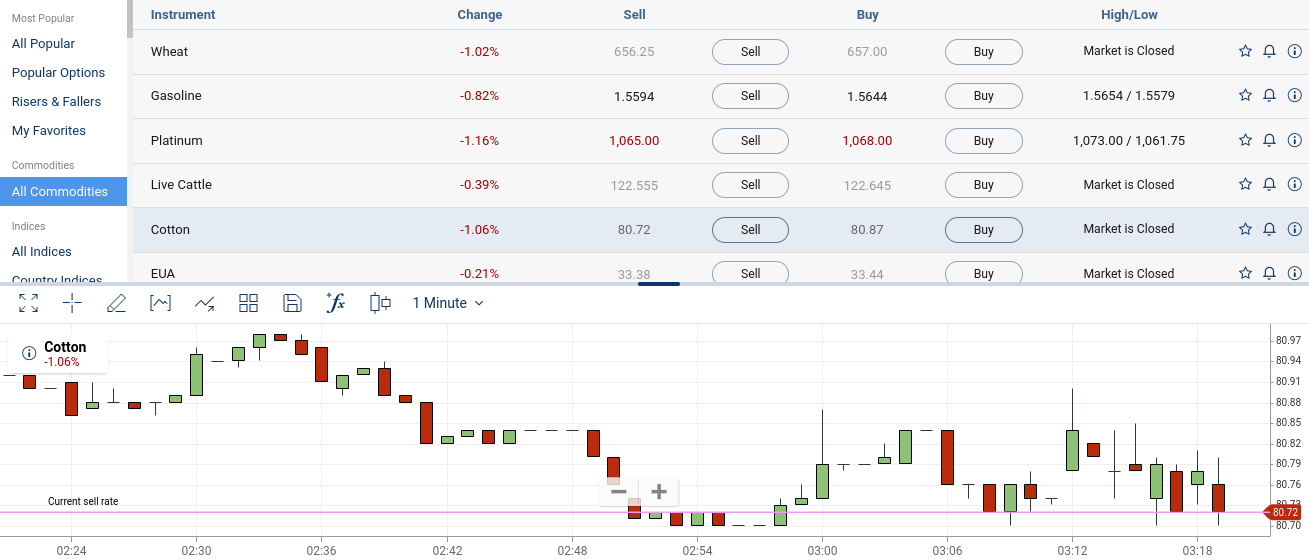

7. Plus500 – Best Paper Trading Account for Leveraged CFDs

Much similar Capital.com, Plus500 is a popular online trading platform that specializes in CFDs. Equally such, if yous're from the US - you won't exist eligible to open an business relationship. Nevertheless, if CFDs are permittable in your land of residence - Plus500 is well worth considering.

This is because the platform gives you access to thousands of markets across dozens of asset classes. For example, you can trade CFDs in the form of futures, options, stocks, ETFs, forex, and cryptocurrencies.

You can too trade commodities like hard metals, energies, and agricultural products. All of these CFD marketplaces at Plus500 can be traded committee-free and with competitive spreads. Plus, Plus500 offers leverage of up to 1:300 to retails. Your personal limits will, however, too exist determined past your location.

When information technology comes to the Plus500 paper trading facility, you lot tin register for this specifically by selecting the 'Demo Business relationship' option. In doing and so, you lot can start trading risk-free without needing to make a deposit. On both the real and demo accounts, Plus500 allows you to seamlessly switch betwixt its desktop platform and mobile app.

The latter is available on both iOS and Android devices and comes with all of the aforementioned account features equally found online. If you decide to upgrade to a existent money business relationship, Plus500 requires a minimum eolith of only £/$100. Supported payment methods include debit/credit cards, bank wires, and Paypal.

Plus500 fees

Pros:

- A commission-gratuitous trading policy

- Thousands of CFD trading markets

- Tight spreads

- In-firm trading platform, bachelor on web browsers and mobile phones

- Plenty of features including adventure management tool, price alerts, and trader'southward sentiment tool

Cons:

- No social trading tools

- CFDs simply

72% of retail CFD accounts lose money.

8. TradeStation – All-time Trading Simulator for Futures and Options

If you have a bit of experience in the online trading space and wish to buy and sell financial derivatives - TradeStation is well worth considering. In fact, fifty-fifty if you have never traded futures or options previously - TradeStation is however a practiced option as it offers a free demo simulator.

This means that yous can enter positions in a completely gamble-gratuitous surround - which is a dandy manner of learning the ropes of complex financial derivatives. In terms of supported markets, TradeStation covers dozens of asset classes across both futures and options.

This includes indices, currencies, interest rates, metals, energies, agricultural products, and more than. If yous decide to upgrade to a real money business relationship, yous tin trade options from just $0.50 per contract. Futures are besides competitively priced at just $1.50 per contract. We should also note that TradeStation is strong in areas other than merely fiscal derivatives.

For example, yous can too invest in stocks, ETFs, bonds, common funds, and even IPOs. This means that the broker is suitable for both curt-term and long-term trading strategies. TradeStation is as well a expert option if you wish to create a retirement programme. This covers Traditional IRAs, Roth IRAs, and SEP IRAs.

TradeStation fees

Pros:

- $0 commission on stocks

- Options charged at just $0.50 per contract

- Thousands of stocks including admission to the OTC markets

- Slap-up mobile trading app

- Excellent reputation

- Paper trading facility

- Suitable for newbies and experienced pros

Cons:

- International assets not as extensive every bit other platforms in the space

Your capital Is at chance.

Paper Trading Guide

If you lot're new to paper trading platforms in general - the sections below will explain how things piece of work. Afterward all, in the vast bulk of cases, yous will yet demand to open a brokerage account to gain access to the respective newspaper trading facility.

What is Paper Trading?

Put just, paper trading is the procedure of ownership and selling fiscal instruments in a risk-gratuitous manner. This is considering yous volition be trading with 'demo funds' equally opposed to real money. This means that you lot tin can learn the ropes of how trading works - as the best demo accounts will mirror live market place conditions.

- For example, if over the course of 15 minutes Apple stocks rise by 0.27% - this volition too be mirrored on the newspaper trading platform.

- Plus, trading volumes, spreads, volatility, and brokerage commissions volition likewise be reflected in your demo account.

- As such, you lot will go a realistic overview of whether or not your trading strategies are profitable - or need tweaking.

As we covered before, nigh online brokers will require you to open up an account before yous can utilise its paper trading platform. In some cases, this is simply a case of supplying some personal information and contact details. Crucially, this ways that you can use the demo facility without needing to upload whatsoever ID or make a deposit.

You will usually be given a stock-still amount in paper trading funds. For example, both eToro and TD Ameritrade will pre-load your demo business relationship with $100k in virtual coin. Webull and Interactive Brokers go further past adding $1 million in paper funds. With that said, yous likely won't need this much - as you lot'll desire to paper trade with stakes that mirror your actual investment upkeep.

Benefits of Newspaper Trading

The best paper trading software providers are suitable for investors of all skill-sets. There are many benefits to using such as platform - which nosotros elaborate on in more item beneath.

Learn Trading for the First Fourth dimension

Perhaps the well-nigh obvious benefit of using a newspaper trading platform is that you tin can learn how to merchandise in a risk-free environment. After all, it's great to build your investment noesis by reading books, taking courses, and watching videos. But, the just true fashion of getting to grips with trading is past really doing it yourself.

For example, yous volition learn how to enter trading orders - such as purchase/sell and limit/market place positions. You can also build your skills in risk-management through stop-loss and take-profit orders. In many cases, yous can use your chosen paper trading balance for as long every bit you wish with no time limit in place.

Test out a new Trading Platform

With hundreds of trading platforms active in the online space - knowing which provider to sign upwards with can be a challenge. This is considering in that location is often very little to separate brokerage sites - with many now offer depression-cost trading services to the retail investors.

This is why the best paper trading platforms are so invaluable - as you exam a new broker out earlier making a fiscal delivery.

For example, yous tin see how much liquidity the platform offers, what the spreads are similar, and how like shooting fish in a barrel information technology is to place orders. And of grade, demo accounts give you a clear indication of how user-friendly the platform is. Once you have tested the broker out in demo mode and are sure the platform is right for you - you can so keep to open up a real money account.

Trial an Automated Trading System

Automated trading is getting more and more popular in the online investment scene. Put simply, this allows you to buy, sell, and trade fiscal instruments in a 100% passive manner. The most common way of doing this is via a trading robot software file that you install into MT4.

One time you agile the robot in MT4 and link it to your chosen brokerage site - it will and so outset trading on your behalf - 24 hours per day. Yet, many trading robots are incapable of making consistent gains - meaning you are putting your difficult-earned capital at risk. This is where the best paper trading platform providers can aid.

Put simply, by using a banker that supports MT4 - such as Libertex or Uppercase.com, you can examination out a new automated trading robot risk-free. In an ideal earth, you will let the robot to trade with your demo business relationship funds for a few weeks to determine how effective it is. If yous end the trial menstruation with notable gains, only then might y'all consider using the robot with existent capital.

Try a Trading Bespeak Service Adventure-Free

Another benefit that the best paper trading apps provide is that you lot can examination out the best forex signals in a risk-complimentary environment. For those unaware, signals are trading suggestions sent to you by experienced investors that research the market on your behalf.

The signal might, for example, tell you to go long on Bitcoin when the digital currency breaches a toll of $58,500. The signal service will also provide you with the required terminate-loss and take-turn a profit order prices. When joining a new signal provider - information technology would be foolish to start trading the suggestions without testing the service out outset.

Instead, it'south a wise idea to place the suggested orders via your chosen paper trading platform. If, after a few weeks, you find that the trading signals are profitable - you might then consider using placing orders with real coin.

Paper Trading Strategies

If you are using a paper trading platform with the intention of becoming a better all-circular investor - there are several strategies that you can take to ensure you become the near out of the demo account facility.

This includes:

Bankroll Management

First and foremost, it's of import to deploy a bankroll management strategy when using a paper trading platform. This should mirror the investment budget that yous have in place - when you eventually get effectually to trading with real capital.

- For example, many of the best paper trading platforms that we have discussed today give you a 6 or 7-figure demo business relationship balance.

- But, if you only have $1,000 in bachelor upper-case letter - it's no skilful placing paper trades with tens of thousands of dollars each.

- This would be an unrealistic amount to be trading with - as it doesn't mirror your bodily investment budget.

Instead, in this scenario, you lot would exist better off setting bated $1,000 from your newspaper trading balance and using this as your buffer.

Risk Management

It is too important that you larn risk-management strategies when using a paper trading platform. This will set you lot in expert stead for when yous eventually become around to trading with real upper-case letter. There are two such strategies that you tin take in this respect.

Firstly, ensure that you lot keep your stakes sensible - and in relation to your perceived investment budget. For example, if you lot have $1,000 bachelor then you should probably limit your stakes to one% - or $10 per trade. Similarly, if yous build your $one,000 up to $2,000 - your maximum stake would then increase to $20.

Secondly, make sure that you always deploy a cease-loss and take-turn a profit lodge when using a paper trading platform. The old will automatically close your position when it goes downward by a certain corporeality - say 3%. The latter will close your position when a sure profit target is triggered - say ten%.

Calculate Risk and Reward

Leading on from the in a higher place section on chance-management, you lot should always enter a paper trading position with articulate targets and goals in mind.

- For example, you might like the wait of Tesla shares, but what is the upside potential. If you recollect there is an upside of 20% - reverberate this in your take-profit order.

- Similarly, consider what the potential downside of your paper trade is. For instance, if you think that a further pullback of 10% on Tesla stocks could bespeak a more prolonged down trend - reverberate this in your stop-loss club.

Either way, by always calculating your potential risks and rewards on a trade - you lot have a clear entry and exit strategy in place.

How to Get Started with the Best Gratuitous Paper Trading Account

This guide has not merely discussed the best paper trading platforms to consider in 2022 - simply some useful strategies that will ensure you lot make the most of your demo business relationship endeavors.

To conclude, we are now going to show you lot how to go started with the best newspaper trading platform provider in the market - eToro. You won't be required to eolith any funds at this brokerage site to utilise its trading simulator - and getting started takes minutes!

Step 1: Open up an Account

Similar well-nigh online brokers offering paper trading facilities - eToro initially requires you to register an account. All you demand to do is supply some personal information - such as your name, address, nationality, engagement of nativity, and e-mail address.

Your capital letter is at take chances.

To forestall people from opening upwards multiple demo accounts, eToro will also ask you to verify your mobile number. Make note of your username and password also - equally you'll demand this to log in to your newspaper trading account.

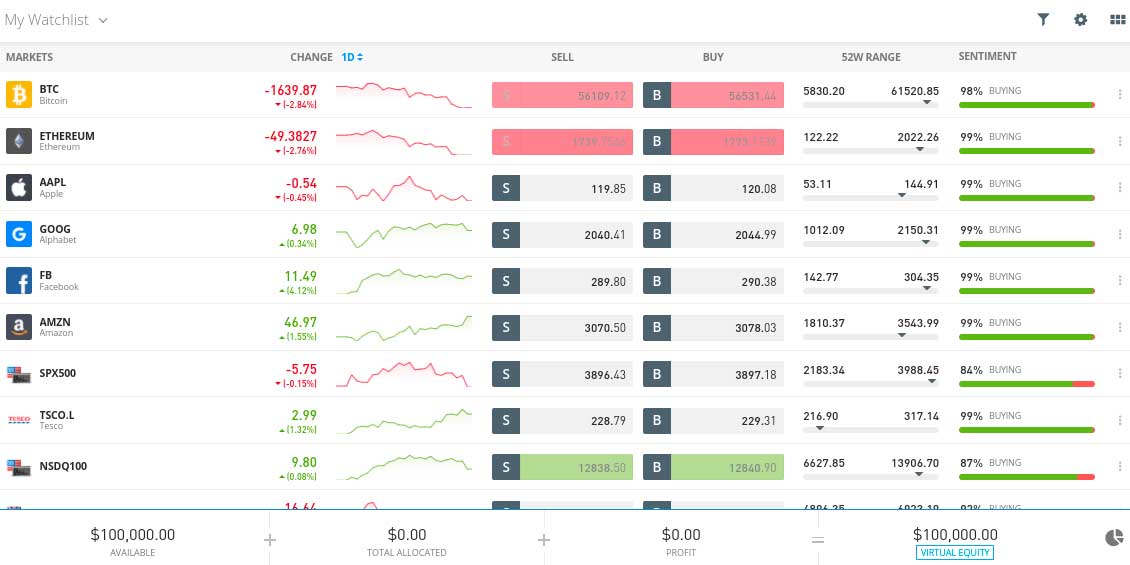

Step 2: Switch to Demo Way

Once you have registered - you tin and then start using the eToro paper trading simulator directly away. First, yous'll need to click on the 'Real' button on the left-paw side of the dashboard and and then click on 'Virtual Portfolio'.

A pop-up box volition then advise you that yous are switching over to virtual portfolio mode. Simply confirm this by clicking on 'Go to Virtual Portfolio'.

A pop-up box will then advise you that you are switching over to virtual portfolio mode. Simply confirm this by clicking on 'Go to Virtual Portfolio'. One time you do, at the bottom of the screen you will notice that you take $100,000 in virtual disinterestedness.

Footstep three: Kickoff Paper Trading

If you have never used eToro earlier - y'all should note that although you are in virtual style, everything you see on-screen mirrors that of the existent money account. The only difference is that any orders you place volition be washed so with your virtual business relationship balance.

Your capital is at chance.

To first paper trading, you lot will first need to select a market. Y'all can browse what markets eToro supports by clicking on the 'Trade Markets' push - which you will detect on the left-mitt side of the dashboard. You can too find a market by using the search box at the peak of the folio.

Pace 4: Place Paper Trading Order

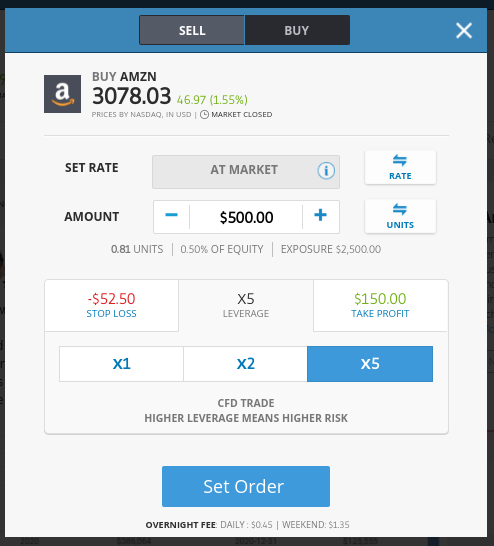

Once you click on the market place that y'all wish to trade, you will and then need to ready upwards an order. First, choose betwixt a 'buy' and 'sell' order - which tells eToro whether you think the asset will rise or fall in value.

Next, it's also wise to enter a stop-loss and take-profit club value. As nosotros explained before, this will allow you to get to grips with run a risk-management when paper trading. You also have the option of applying leverage.

To analyze, in the example gild box above - we are doing the following on an Amazon stock paper merchandise:

- Buy Order: This means we think Amazon stocks will increase in value

- Corporeality: We are staking $500 from your virtual account residuum

- Leverage:We are applying leverage of 5x - pregnant that our $500 stake is now worth $2,500

- End-Loss: We have a stop-loss order gear up at -$52.50 - which is ten.5% of our position

- Take-Profit: We desire to close our trade when it is xxx% upward - and so nosotros place a take-profit order at $150

Finally, to place our paper trading order - we click on the 'Set Society' button.

Step v: Deposit and Upgrade to Real Coin Business relationship

Once you experience comfy with how eToro works and are set to upgrade to a real coin account - all you need to practice is switch dorsum to 'Real Portfolio'. Then, it'due south just a case of making a eolith. You can practise this instantly by using a debit/credit card, Paypal, Skrill, or Neteller. When your account is funded and yous are in real manner - yous tin can start trading with your remainder.

Conclusion

The best paper trading platforms that we accept discussed today are suitable for both newbies and seasoned pros. If you fall into the camp of the one-time - yous will be able to acquire how trading works without needing to risk any capital.

In fact, in most cases, y'all are not required to make a eolith to gain access to the demo account. If you lot're an experienced investor - the best paper trading platforms let you lot to examination out new strategies or even automated robots gamble-free.

Either way, if you're looking to become started with the all-time paper trading platform right now - yous could be placing your kickoff trade with eToro is less than 5 minutes. Simply register an account and you will accept access to a $100k paper trading residual!

eToro - Free Paper Trading Business relationship with $100k in Virtual Funds

Your upper-case letter is at risk.

67% of retail investor accounts lose money when trading CFDs with this provider.

FAQs

How does paper trading work?

Paper trading refers to the process of using 'demo funds' to trade financial instruments. This is something offered by many online brokerage firms. The all-time paper trading platforms will mirror real-world market conditions.

What is the all-time paper for day trading?

Nosotros found that the best newspaper trading platform for 24-hour interval trading is eToro. This is considering y'all will accept admission to a $100k newspaper trading rest which you tin employ across thousands of markets. This includes stocks, ETFs, indices, crypto, commodities, and forex.

Can y'all trade papers with leverage?

Yes, if your called paper trading broker offers leverage - information technology is likely that you can utilise this to your positions in demo way. As ever, leverage limits are dictated by several factors - such every bit your country of residence, the nugget beingness traded, and whether yous are a retail or professional client.

Tin can you get newspaper trading signals?

Yes, paper trading platforms are ideal for signals - as yous tin test out the provider without risking any money. In an platonic earth, your called signal provider volition offer a gratis trial, which you tin can then employ in conjunction with a paper trading platform.

What are the revenue enhancement laws for trading papers?

If you are using a paper trading platform - this ways that you are non trading with real money. As such, any profits that you brand are virtual and thus - will not be liable for upper-case letter gains tax.

Does Robinhood offer a paper trading platform?

Although Robinhood is often the go-to banker for newbies, it is surprising that the provider does not offer a paper trading facility. Instead, yous can only trade with real coin.

Source: https://tradingplatforms.com/paper/

Posted by: sisksurtly.blogspot.com

0 Response to "Best Forex Trading App Australia"

Post a Comment